We administer. You invest.

The smart way to invest your IRA or 401(k) in alternative assets.

As seen in:

-

IRAfi Crypto™

IRAfi Crypto™

-

Self-Directed IRA

Self-Directed IRA

-

Self-Directed IRA LLC

Self-Directed IRA LLC

-

Solo 401(k)

Solo 401(k)

-

Self-Directed HSA

-

Self-Directed ESA

With the all-new IRAfi Crypto™ trading app, you can now buy, sell, and trade the most popular cryptos including Bitcoin, Ethereum and XRP (plus over 25 more) for a low, flat annual fee of just $100.

Benefits:

Benefits:

(with credit card on file)

By utilizing the IRA LLC structure, you have total “checkbook control” to make investments when you want, without custodial consent.

Benefits:

(with credit card on file)

Benefits:

(with credit card on file)

Benefits:

(with credit card on file)

Benefits:

(with credit card on file)

Which solution works for you?

Self-Directed IRA LLC

You get total control

Self-Directed IRA

We do everything

Solo 401(k)

Self-employed

Did you know most Self-Directed IRA investors use their retirement funds to invest in real estate? Learn More: Self-Directed IRA for Real Estate

We want to work with you

Individual, institution, or advisor—we’ll handle all your IRA or 401(k) alternative asset custody needs.

We Handle Everything

We open your self-directed bank account, handle all IRS reporting, and offer annual IRS compliance services.

Simple Pricing

Our self-directed plans have no account value fees, account management fees, or minimum balance requirement.

For Institutions & Advisors

Gain online access to client accounts and generate fees from your clients’ investments in alternative assets.

How IRA Financial Works

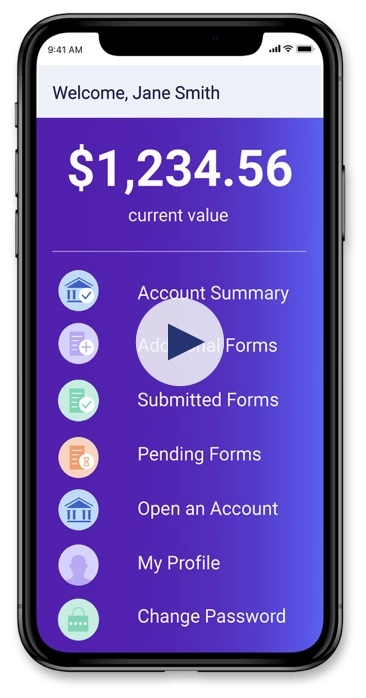

IRA Financial is simplifying how you invest your retirement funds in alternative assets. Open an account on our app and start investing for a simple, flat fee.

Pay a flat fee

No hidden fees, minimum investment amount, or balance requirement.

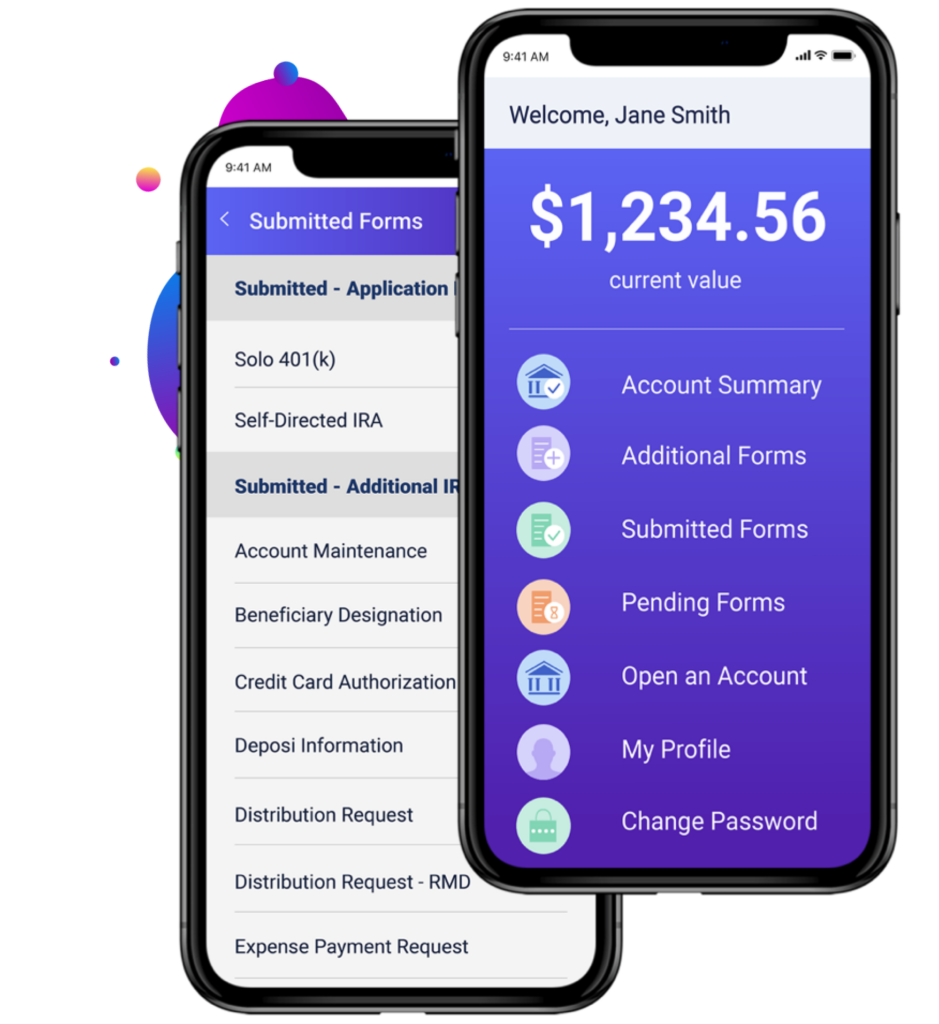

Do everything on our app

Open your account, rollover your funds, and start investing all from the palm of your hand.

Control your investments

Our self-directed solutions let you start investing in assets you know and understand quickly and easily.

How we're different

Experience

Our tax and ERISA experts have helped over 24,000 clients invest $3.2 billion in alternative assets.

Prestige

Our founder, Adam Bergman, was a tax lawyer and is the author of 8 books on self-directed retirement plans.

Dedicated Support

In addition to tons of online resources, IRA Financial gives clients access to experienced specialists dedicated to your peace of mind.

Our latest content.

A client explains why he chose IRA Financial!

“I first tried working with [another provider]…When I proceeded to my due diligence, I was so disappointed by multiple aspects of the trust company documents that I backed out of the entire transaction…I then turned to IRA Financial.

Having been burned once, I snooped around to identify the trust company (IRA Financial Trust), found their “forms” webpage, and reviewed all the relevant forms before proceeding. Overall, the application process with IRA Financial was not too painful. Even better, they did signatures via DocuSign and in the process presented all the relevant documentation including information about fees and minimum account balance requirements.”

Read Article →

R. Paul Drake

Portfolio strategy, dividend investing, REITs, closed-end funds