Endless investment opportunities

Learn more about what you can invest in with a self-directed retirement plan.

This is tax-free investing

With a self-directed solution, you can invest in almost anything and the income generated from those investments is tax free. Our in-house tax and ERISA professionals will guide you through establishing a self-directed retirement account and ensure it always remains compliant.

Real estate, including residential and commercial, rentals, raw land, and flips, remains the most popular alternative investment.

Investment opportunities offered to a select group of high net worth or institutional investors that have reduced risk and assured returns.

Cryptos, such as Bitcoin and Ethereum, offer one the ability to invest in an emerging asset class.

Tax liens and deeds allow for exposure to the real estate market in your portfolio without having to invest in the properties themselves

Metals and coins have long been used as a hedge against a volatile economy – just make sure they are IRS-approved precious metals and not held personally.

Hedge funds and private equity fund investments are generally for more sophisticated, accredited investors.

Never step a foot in a bank

Our relationship with Capital One ensures we can open your account with no wiring fees or minimum balance requirement. No need to sign paperwork or go to a bank—we take care of everything.

How IRA Financial Works

IRA Financial is simplifying how you invest your retirement funds in alternative assets. Open an account on our app and start investing for a simple, flat fee.

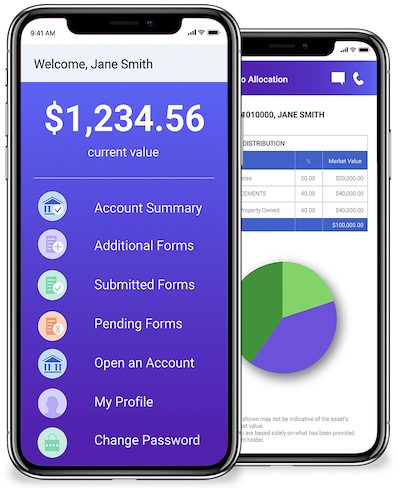

Do everything on our app

Open your account, roll over your funds, and start investing all from the palm of your hand

Pay a flat fee

No hidden fees, minimum investment amount or balance required (with credit card on file)

Control your investments

Our self-directed solutions let you start investing in assets you know and understand quickly and easily.