Solo 401(k) for Real Estate Agents

A Solo 401(k) Plan (also known as an Individual 401(k) or Self Directed 401(k) plan) offers a self employed business owner, such as a realtor or real estate agent the ability to use his or her retirement funds to make almost any type of investment. This can include real estate, tax liens, private businesses, precious metals, and foreign currency without custodian consent. You can accomplish all of this tax-free! In addition, a Solo 401(k) Plan will allow a real estate agent to make high contribution limits (up to $73,500) as well as borrow up to $50,000 for any purpose. The Solo 401(k) Plan is an ideal retirement solution for the self-employed real estate agent who is looking to save for their retirement while investing in what they know – real estate!

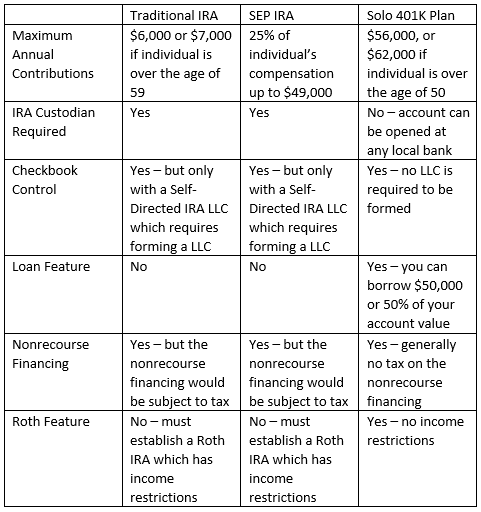

The Solo 401(k) Plan offers a self-employed realtor the greatest retirement, tax, and investment advantages – more than the Traditional IRA, SEP, or SIMPLE IRA. A Solo 401(k) plan offers the same investment opportunities as a Self Directed IRA LLC, but without the need to hire an IRA custodian, or create an LLC.

The 2001 Economic Growth & Tax Reconciliation Act (EGTRA), greatly increased the popularity of the Solo 401(k) Plan. The Solo 401(k) Plan has become a popular retirement vehicle for real estate agents across the country. As a real estate agent, there are many features of the Solo 401(k) plan that make it so appealing and popular among self employed business owners. The following chart will illustrate the advantages for a self-employed attorney of using a Solo 401(k) Plan:

Solo 401(k) for Real Estate Agents vs Other Retirement Plans

Two Types of Contributions = Higher Maximum Contribution

In addition, the following example clearly illustrates the advantages for a self-employed real estate agent to use a Solo 401(k) Plan over a Traditional IRA and SEP IRA.

Beth who is a real estate agent earns a $100,000 a year. Beth is 43 years old and the sole shareholder of an S Corporation called ABC, Inc. Beth is the sole owner and employee of the corporation. Beth wishes to make the maximum amount of tax-deductible contributions allowed by law. If Beth used a Traditional IRA, she would be able to make a tax-deductible contribution of just $6,000. Whereas, if she had used a SEP IRA as the retirement vehicle, Beth could make a tax-deductible contribution equal to $25,000 (25% of $100,000). However, if Beth establishes a Solo 401(k) Plan, she can make a tax-deductible contribution of $43,000 ($19,000 as an employee and a corporation profit sharing contribution equal to 25% of her compensation).

Retirement Benefits of the Solo 401(k) for Real Estate Agents

The Solo 401(k) plan is good for real estate agents and self-employed realtors, because it offers the greatest retirement benefits. In addition, by using a Solo 401(k) Plan, Beth can borrow $50,000 or 50% of her account value and use that loan for any purpose, with the ability to invest in real estate and other investments tax-free and without custodian consent. Moreover, real estate agents and the self-employed can open the Solo 401(k) plan at any local bank, such as Capital One. Real estate agents can roll over his or her former 401(k) or IRA funds to the new Solo 401(k) Plan tax-free – only Roth IRA or after-tax 401(k) funds are not permitted to be rolled into a Solo 401(k) Plan.

For a real estate agent, using a Solo 401(k) as a retirement plan will allow such individuals to:

- Make high annual contributions (up to $73,500 if over the age of 50)

- Borrow up to $50,000 tax-free

- Invest in real estate & more tax-free and without custodian consent

Get in Touch

To learn more about the advantages of using a Solo 401(k) Plan, contact IRA Financial Trust directly at 800-472-1043. You can also fill out our contact form to speak with a Solo 401(k) specialist. We look forward to hearing from you.