In general, IRAs and other retirement plans are not overly complicated to use. However, there are several important IRA rules you should be aware of. This is especially true for Self-Directed IRAs. Failure to follow the rules may disqualify your plan. Thus, all funds and investments held by your Self-Directed IRA will be distributed to you. They will no longer be tax-advantaged AND all assets will be taxable during the year in which the distribution is taken. It’s imperative that you know the most important Self-Directed IRA rules and can grow your assets until you retire.

Top 5 Most Important IRA Rules

The Prohibited Transaction Rules

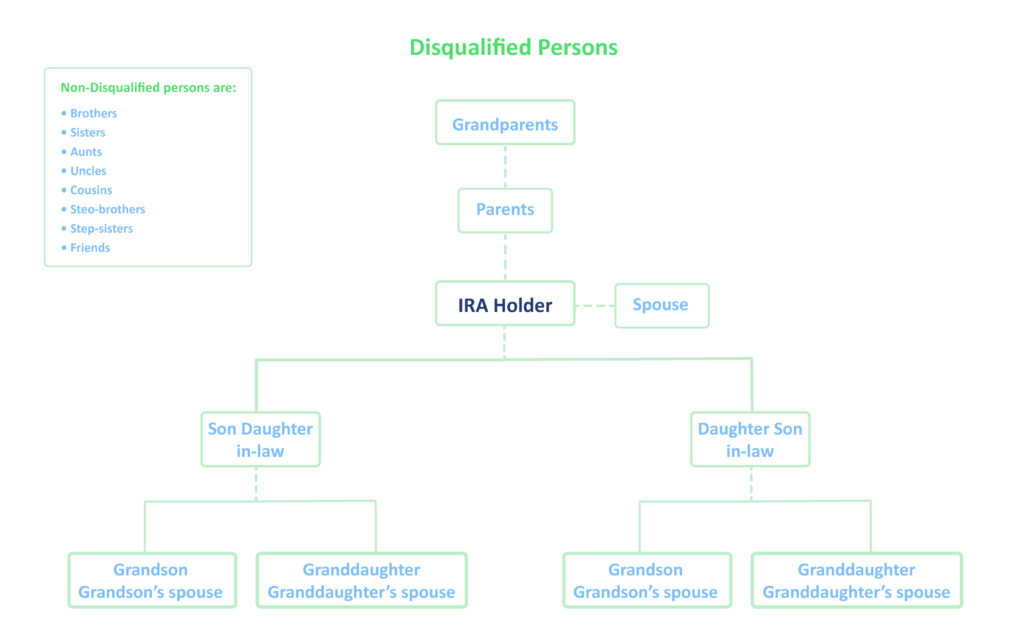

The most important set of rules you should be aware of are the prohibited transaction rules. In general terms, your IRA must be the sole beneficiary of your IRA investments. You, as the IRA holder, cannot personally benefit from an asset held in your IRA. Further, lineal ascendants and decedents, in addition to their spouses, cannot benefit either. See chart below:

The reason for this is since the IRA itself is already receiving tax advantages, you cannot receive any other advantages from the IRA investment. For example, if your Self-Directed IRA is invested in a vacation property, you cannot stay there yourself. Further, your parents, children and grandchildren cannot stay there either. On the other hand, an aunt, brother or friend may utilize the property. This is because they are not considered a disqualified person.

Contribution Limits

Each year, the IRS set the contribution limits for all retirement accounts, including IRAs. Oftentimes, the limit remains unchanged from the prior year. However, because of inflation, they may raise the annual limit. For 2023, the amount you can contribute to any IRA is $6,500. If you are age 50 or older, a catch-up contribution of $1,000 is also available to you.

If somehow you over-contributed to your IRA, you may withdraw the excess contribution. This must be done so in a timely matter. Failure to correct the mistake will have consequences. You will be hit with a six percent penalty each year the mistake is not rectified. Note that the contribution is for all IRA plans. If you have more than one IRA, they must remain under the limit in total.

Early Withdrawal

All retirement plans are tax-advantageous. Because of this, the IRS has set rules to deter anyone from withdrawing from his or her retirement account too early. You must have reached age 59 1/2 to start distributing funds from your IRA. If you decide to take funds out before this age, you will incur a 10% early withdrawal penalty. There are some exceptions that include first time home purchase, higher education expenses and becoming permanently disabled.

There is also an exception if you contribute to a Roth IRA. Since Roths are funded with after-tax money, you can withdraw your contributions at any time and for any reason. However, if you withdraw any earnings from a Roth IRA, they will be subject to the early withdrawal penalty.

Required Minimum Distributions

As we just said, you may start taking distributions from your IRA once you reach age 59 1/2. However, once you reach age 73, you MUST start taking distributions from your traditional IRA. These are called Required Minimum Distributions, or RMDs. Failure to take your RMD in any given year will lead to a FIFTY percent tax on the amount not withdrawn. As with an over-contribution, this tax will keep occurring until it is corrected. Since traditional plans are funded with pretax money, the IRS decided on an age when you must pay those taxes. All distributions (including earnings) will be taxed at your current rate.

Again, Roth IRAs are totally different. There are no RMDs for them. You’ve already paid the taxes on your contributions. Because of this, all qualified distributions are tax-free. Therefore, you never have to withdraw money from your Roth. You may choose to let it grow unhindered to pass along to your beneficiaries when you die.

Alternative Asset Investments

The great thing about the Self-Directed IRA is alternative asset investments. No longer are you handcuffed by what investments your financial institution offers. When you have a passive custodian, such as IRA Financial, you can invest in just about anything you wish. Investments range from real estate and precious metals to hard money loans and cryptocurrencies. Of course, if you want to invest in traditional assets, like stocks and mutual funds, that’s allowed too.

We then come full circle back to the prohibited transaction rules. We mentioned already that you can’t invest with a disqualified person. There are two assets that cannot be invested with your Self-Directed IRA. These are life insurance and most collectibles, such as art and rugs. Just about everything else is fair game, so long as it’s federally legal in the United States!

Important IRA Rules – Conclusion

As you can see, there are some important IRA rules to be aware of. If you work with an experienced IRA provider, rest assured your IRA will remain IRS-compliant. It’s out top priority to make sure our clients’ retirement planning stays on track.

If you have any questions, feel free to give us a call @ 800.472.1043. We’re happy to help in any way we can. Look forward to hearing from you! Alternatively, you can check out the all new IRA Financial app to get started.